Container Rates Soar to 7-Year Highs

Introduction

The Container market is recovering well from the global pandemic and we have witnessed rates within the sector soaring to 7-year highs.

A strong rebound in demand has created a shortage of supply. One of the largest increases in rates has been seen in the 8,500 TEU sector where 1-year time charter rates have tripled in value from the lows of June 2020 This is due to a combination of very strong cargo demand in Asia and an increasing shortage of 40 Containers which has seen spot rates for Chinese export rising sharply over the last few weeks. This has been further amplified by the stockpiling of goods and the seasonal Christmas period.

We have also observed the number of available slots on almost all trade lanes is at anall-time low amid the resurgence in demand and logistical problems and equipment shortages are also driving rates up.

Container Values

Figure 1 demonstrates the effect of rates and cargo demand on the 5-year-old market values for 18,000 and 13,000 TEU vessels. The Container market was impacted significantly by the COVID-19 pandemic and we saw values decrease by c.15% between January 2020 and June 2020 (when values hit an all-time low). However, since June the Container market has rebounded, particularly for the larger tonnage. Values have increased to above and beyond January 2020 levels with a total increase of c.18% demonstrating how a market can fluctuate.

Figure 1 shows the historic values for 18,000 TEU and 13,000 TEU Containers in USD mil since January 2020

Sale and purchase history

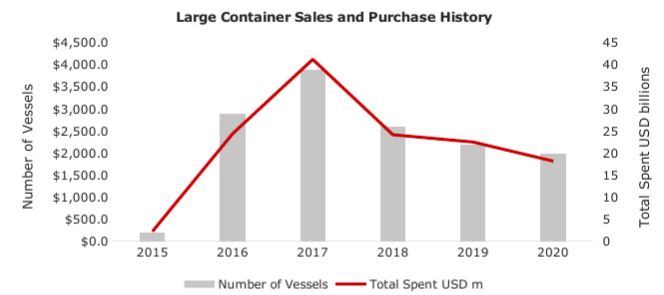

The sale and purchase market has remained relatively stable for Container tonnage >10,000 TEU even though we had much lower demand during the summer months due to the pandemic.

Figure 2 shows historic sale and purchase activity for Containers >10,000 TEU over the past 5 displaying number of vessels and the total amount spent in USD bn.

Over the past 5 years, 2017 has demonstrated the highest number of transactions and the highest amount of USD spent totalling over USD 4 bn. As we approach the end of 2020 only half the number of transactions have taken place and only a total of USD 2 bn has been spent in the second hand S&P market.

Figure 3 shows the biggest buyers in the Large Container sector over the last 5 years by number of vessels and total spent in USD bn.

Figure 4 shows the biggest buyers in the Large Container sector over the last year by number of vessels and total amount spent in USD bn.

Although COSCO Shipping lines (see figure 3) have been the biggest buyers over the last 5 years, they are nowhere to be seen in 2020 (see figure 4). Seaspan have been the biggest players in the market this year with a total of USD 0.8 bn spent by them in second-hand transactions.

Before Covid-19 broke out Seaspan bought 4 x 11,923 TEU vessels, built 2017-2018 at Jiangsu Yangzijiang for a total price of USD 367 mil, the deal included a long-term charter from PIL.

When things relaxed slightly in the summer months Peter Dohle offloaded 2 x (13,371 TEU, 2010 and 2011 built, Samsung) to Seaspan for a total price of USD 146 mil, the deal included a charter to Hapag Lloyd. The more recent deals took place at the end of September and into early October for 2 x (11,923 TEU, 2018, Jiangsu Yanzijiang) built vessels for a price of USD 88 mil each.

Newbuilding History

The newbuilding market for Large Containerships saw a boom in orders during 2015 (see figure 5) with a total of USD 12 bn spent by market players. With the average age of the fleet between 0 -5 years old, many of these vessels have since been delivered and are already operating on the water.

Figure 5 shows historic newbuilding activity for Containers >10,000 TEU over the past 5 displaying number of vessels and total spent in USD bn.

Figure 6 shows the biggest orderers in the Large Container sector over the last 5 years by number of vessels and total spent in USD bn.

Figure 7 shows the biggest orderers in the Large Container sector over the last year by number of vessels and total amount spent in USD bn.

Although 2020 showed uncertainty at the beginning of the year, the surge in Container rates looks to have prompted a number of larger owners to order these ‘megamax’ vessels. OOIL (Orient Overseas International Limited), parent company of the ocean carrier OOCL is one of them (see figure 7). OOCL have not appeared in the big Containers orderers over the past 5 years (see figure 6), due to 12 vessels ordered this year, they are clear winners spending over USD 1.6 bn on 12 x 23,000 TEU megaships.

The orders consist of 7 x 23,000 TEU sized vessels, with a build date between 2023 and 2024 at either Dalian or Nantong COSCO. The total cost of all 7 is USD 1.104 bn or about USD 157.7 mil per ship.

This adds to the orders placed in March which consisted of 5 x 23,000 TEU megamax Containers, build date 2023 and 2024 at either Dalian or Nantong COSCO. Taking the total price of all 12 ships ordered by OOCL to USD 1.88 bn.

Post Panamax 8,500 TEU charter rates

Figure 8 shows 8,500 TEU 1 year time charter rates in USD/day from 2018 through to 2020

Although there are no recorded charter rates for >10,000 TEU vessels the 8,500 TEU Post Panamax charter rates are a good indicator of how the market has been affected. Between January of this year and June, charter rates fell by 60%. This was due to a significant drop in demand between China and the US, two of the biggest consumers in the world. Exports from China dropped c.18% during this period and imports into the US fell by c.30%. However, as China started to recover from the Pandemic during the summer months, and the European market opened up again a massive resurgence in rates took place. Rates have now soared to 3 times the USD/day that was being achieved in June with current figures around the USD 36,000 per day mark. They are still not showing any signs of weakness which gives us confidence going into the new year and Q1 of 2021.

Conclusion

Rates have increased 3-fold for 8,500 TEU containers from the lows of June 2020 with demand being the key driver of this global increase. A combination of strong demand in Asia and an increasing shortage of Containers has sent the market mad. Container volumes at China’s largest container port Shanghai recorded a new monthly high due to the growth in China’s export volumes amid strong demand from the US and Europe due to the Christmas period as well as bulk buying ahead of the UK’s departure from the EU.

The S&P and newbuild market has remained relatively healthy for vessels >10,000 TEU amid the pandemic with major players like Seaspan and OOCL taking advantage of the volatile market.

Rates are still increasing as we approach the middle of December which bodes well as we enter the new year of 2021.

Olivia Watkins -

YORUM KAT